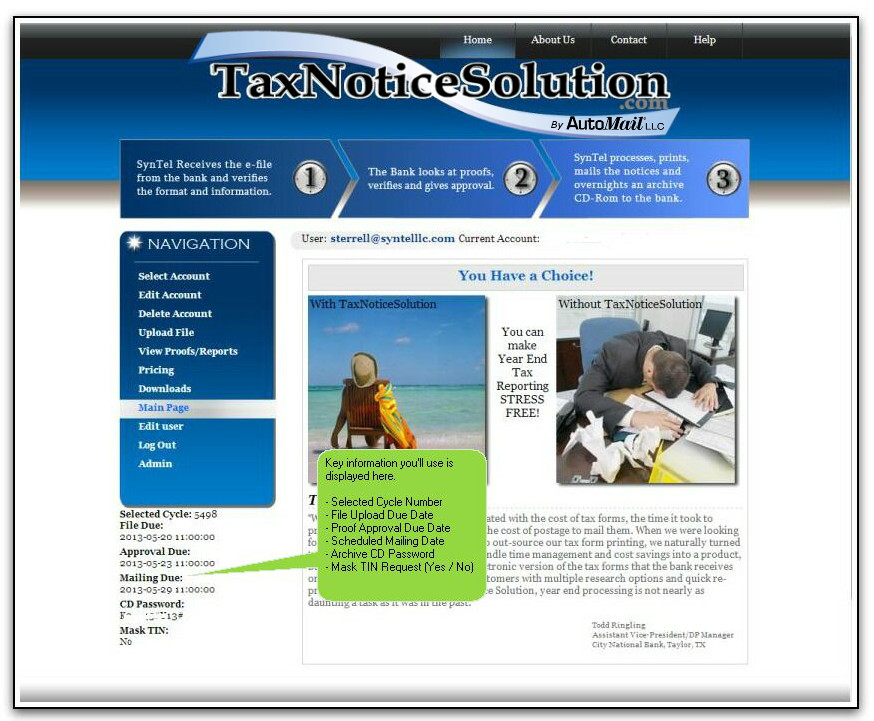

Click to expand the topics below to step through the simple process TaxNoticeSolution™ follows; from account creation to final proof approval.

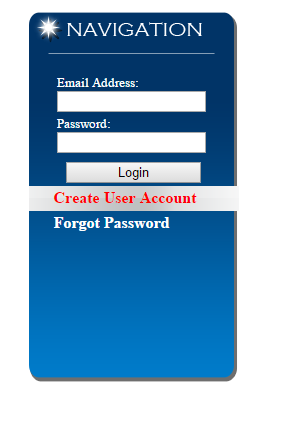

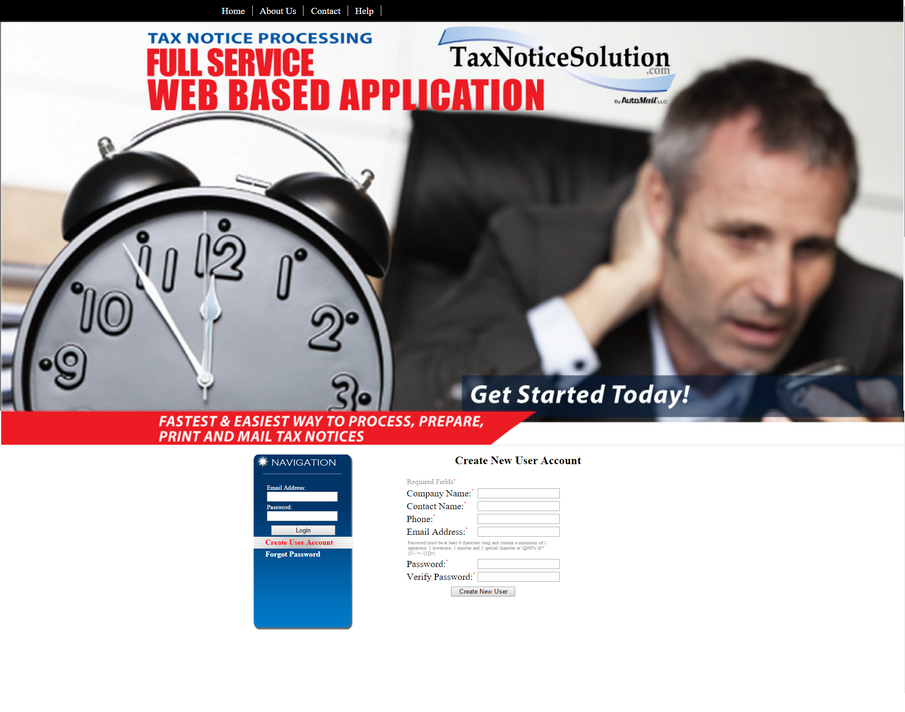

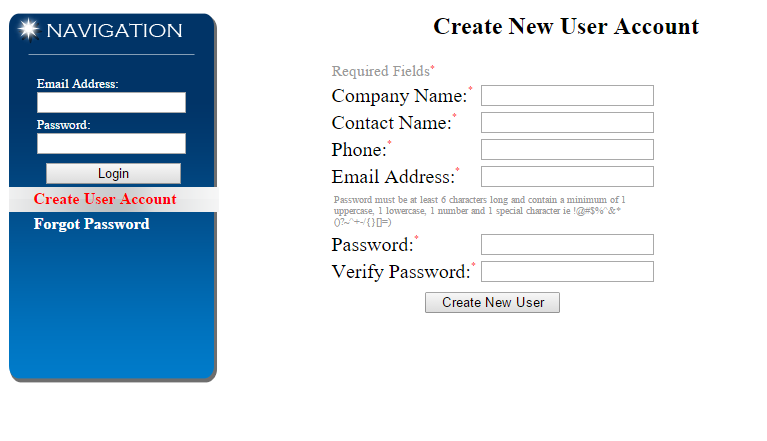

| B. | Select Create User Account in the NAVIGATION menu. |

NOTE: User accounts and information are purged each tax year. This aids in account contact accuracy.

| D. | You will receive an e-mail indicating the successful creation of your TaxNoticeSolution™ account. |

|

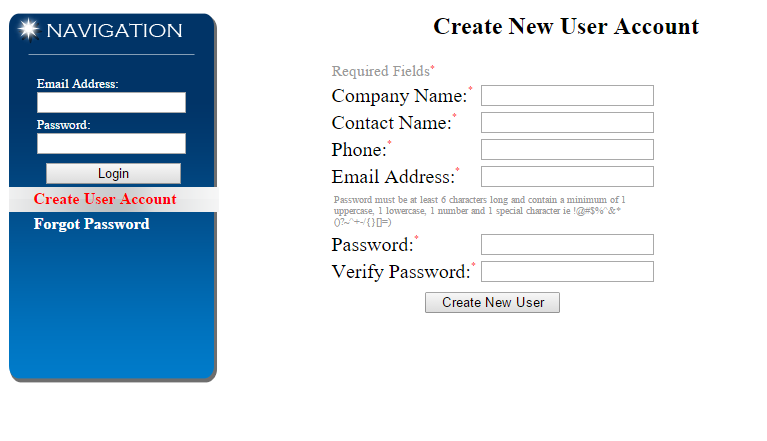

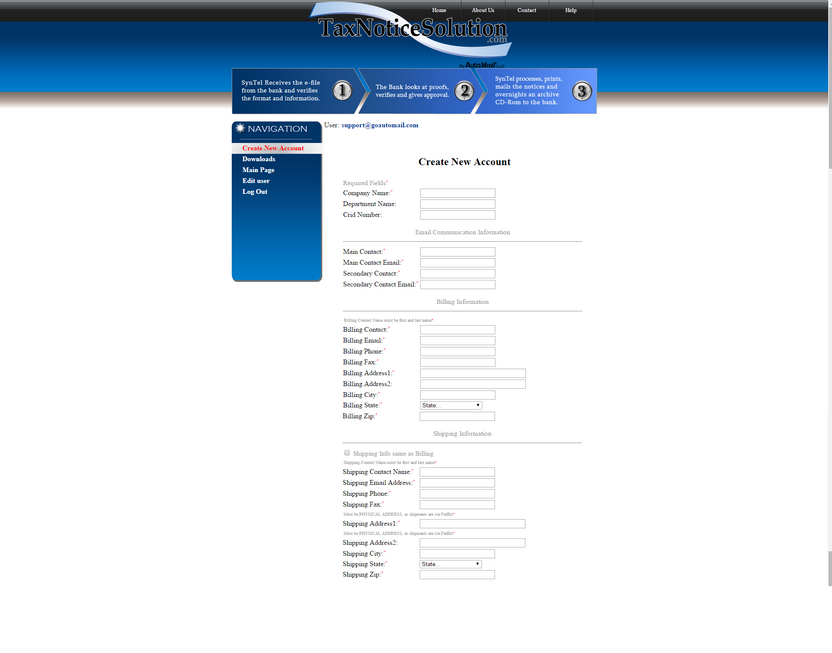

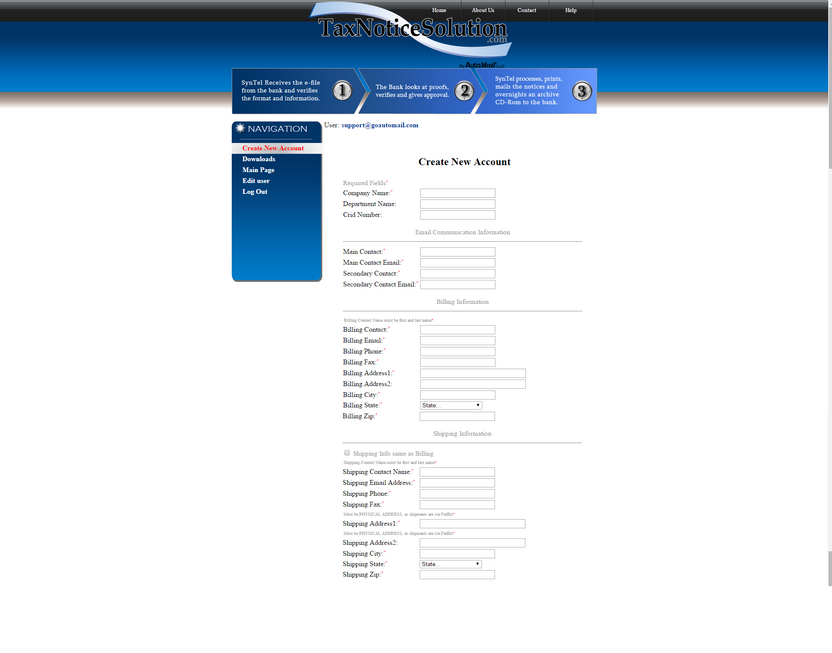

| B. | Select Create New Account. |

| C. | Be sure and add the Main Contact and Main Contact Email information. This is to whom any communications (telephone or e-mail) will be directed for any inquiries or discussion about your TaxNoticeSolution account or processing of notices. This is not necessarily the same contact as the Billing Contact or the Shipping Contact, though it certainly can be. |

| D. | Complete Billing Contact and Shipping Contact information accordingly, then scroll down the page to edit File Information. |

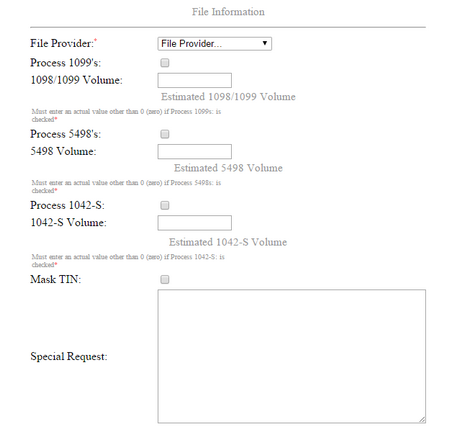

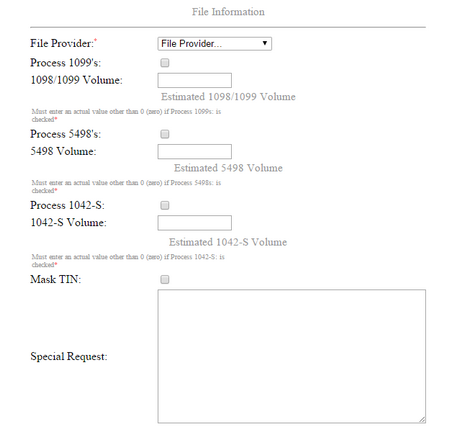

| E. | Complete File Information fields. |

| I. | Select your File Provider from the pull-down list. |

| 1. | This is the system from which your tax file will originate. |

| II. | Next, check appropriate boxes, depending on contract, indicating your desire to process 109? forms and 5498 forms. |

| 1. | Enter the Volume: amount as per what was contracted. The Volume: field is simply used, by TaxNoticeSolution™ processors, to provide a simple estimate of the number of accounts / mail-pieces you'll be providing for delivery. |

| 2. | IMPORTANT: If you desire masking of Tax Identification Number for your customers you must select Mask TIN: here. |

| 3. | Enter any Special Request: information you need to communicate. We try and cover the most common requests (e.g. Mask TIN) with a specific field, but use the Special Request: field to communicate anything specific you may desire. |

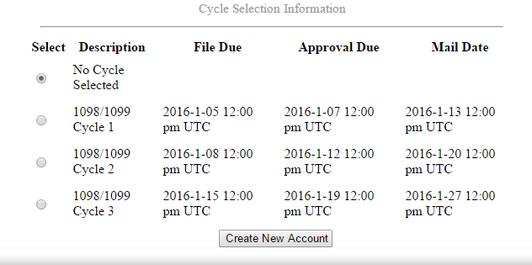

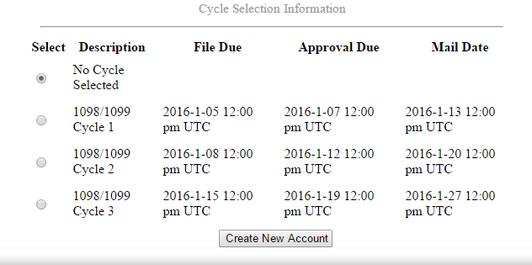

Scroll down the same page to Cycle Selection section

|

You will be notified, via e-mail, when cycle selection is available. This process, for all tax notices, begins around early to mid December each year. That is when we clear database information and prompt you to perform the steps outlined in these 3 sections you just reviewed.

| A. | Select a desired cycle for processing |

NOTE: "optional" print / mail cycles typically only apply to 1098 / 1099 processing in January. 5498 notices are typically processed in a single cycle. This can change, depending on quantity of notices.

| B. | Review all information on the form. |

| C. | Once satisfied that all information is accurate click the Create New Account button to save all information. |

|

| A. | If requesting explicit proofs (accounts) or no-mails download the Proof / No-Mail spreadsheet. |

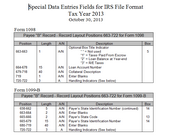

| | click to view larger image |

| B. | Determine whether or not you'll need to utilize special handling fields. Your file originating vendor (core vendor) may need to observe this. |

| | click to view larger image |

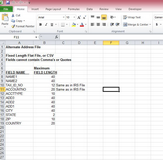

| C. | Alternate Address File: (exclusive to Jack Henry & Associates Inc. core) - Additional programming required. If desired to utilize an Alternate Address File, then we will need to know in advance of receiving the test / live files. |

| | click to view larger image |

|

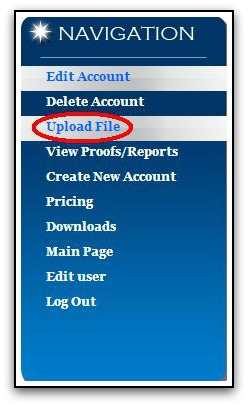

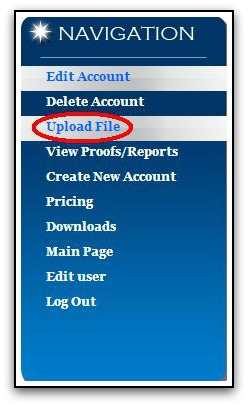

Once you've received indication, from TaxNoticeSolution™, to create and edit your account information the next step is to upload your IRS Publication 1220 or 1187 formatted tax file. The process, for all tax notices, begins around early to mid December each year. That is when we clear database information and prompt you to perform the steps outlined above.

| B. | You'll select the tax file provided you from your originator (host / core system vendor) and upload. |

| C. | TaxNoticeSolution™ representatives will receive notification that your file has been uploaded. |

| D. | The next steps are on us. If formatted properly, your file will be processed and proofs posted for your review. Average turn-around is 1 - 3 days. |

| E. | Once TaxNoticeSolution™ has processed your file you'll be prompted to review your proofs. |

| F. | Go to next section below. |

|

| A. | The TaxNoticeSolution™ e-mail address, by which you created your account, will receive an e-mail from tnsadmin@taxnoticesolution.com. |

| B. | This e-mail will indicate files available to proof and provide a hyper-link to the TaxNoticeSolution™ site. |

| D. | You'll be directed to a page displaying sample PDFs to review (proof) |

| E. | If you ACCEPT the proofs they will be moved into production mode to prep for print and mail. |

| G. | Once FINAL APPROVAL is performed on your notices they will be printed and mailed on, or before, the scheduled date. |

|